JINLING METALS | Stainless Steel Market Update

Stainless Insights in China from July 28th to August 1st.

MARKET TREND | Stainless Steel Prices Return to Rationality Amid Macroeconomic Normalization

Last week, stainless steel futures in the Wuxi market experienced an initial surge followed by a retracement. While broader commodity markets trended lower, raw material costs remained largely stable. Shipments declined modestly, and inventories saw minor drawdowns. By Friday, the main stainless steel futures contract settled at US$1920/MT, down 1.46% week-on-week, hitting a low of US$1910/MT.

Spot prices for stainless steel materials—coils, sheets, and tubes—moved within a narrow band. A broad pullback in previously bullish commodities triggered a shift in sentiment, amplifying volatility. Structural challenges in the stainless steel sector persist, with off-season demand remaining weak and actual consumption limited.

PRODUCT FOCUS

300 Series: Futures and Spot Diverge; High Inventory Caps Rebound Potential

304 cold-rolled (four-foot, private mills) hovered at US$1885/MT, unchanged from last week. Hot-rolled quotes reached US$1850/MT, up US$7/MT. Despite early expectations tied to China's “anti-involution” stimulus, policy momentum slowed. At the same time, overseas tariff pressures resurfaced, creating a tug-of-war between bullish and bearish positions.

Production curbs fell short of expectations, with some mills fulfilling only 80% of planned volumes. Although inventory levels are gradually declining, they remain elevated, limiting prospects for sustained price recovery.

200 Series: Short-Term Rebound Faces Resistance at Higher Price Points

Spot prices recovered slightly:

- 201J2 cold-rolled: US$1095/MT (+US$14)

- 201J1 cold-rolled: US$1195/MT (+US$14)

- 201J1 hot-rolled: US$1165/MT (+US$14)

Positive sentiment early in the week prompted modest price hikes and increased procurement. However, as futures weakened mid-week, buyer caution returned. While 201J2 prices held steady, higher quotes faced resistance amid sluggish trading.

400 Series: Stable Market Dynamics for 430

430/2B spot prices in Wuxi remained steady at US$1135/MT. Inventory from TISCO declined, while JISCO’s cold-rolled inventory saw slight increases. Overall stock drawdowns accelerated, supported by relatively healthy downstream activity.

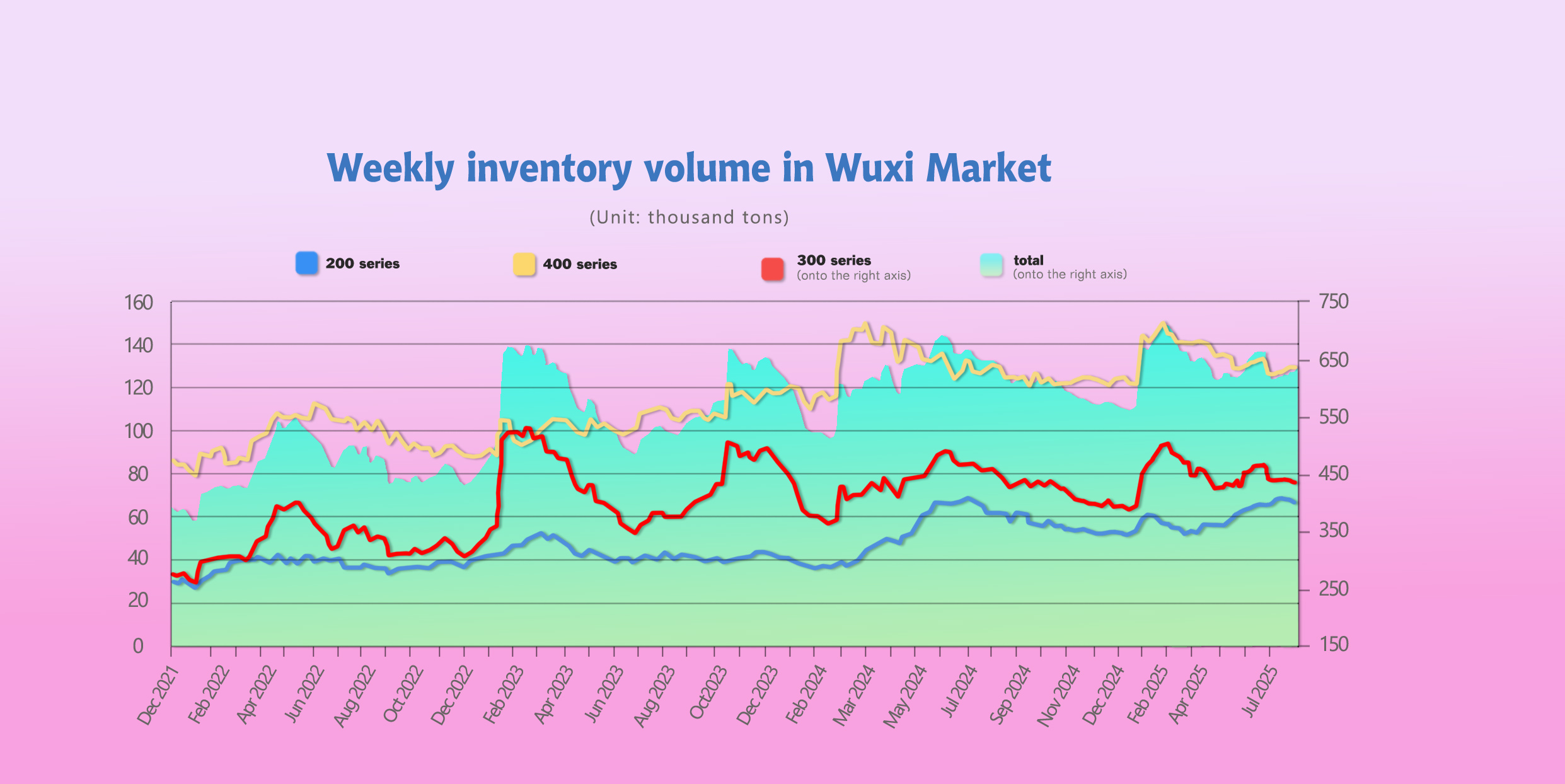

INVENTORY MOVEMENT | Over 10,000 Tons Depleted in a Week

As of July 31st, total stainless steel inventory in Wuxi's sample warehouses stood at 620,773 tons, down by 12,680 tons week-on-week.

- 200 Series: −2,809 tons to 65,101 tons

- 300 Series: −8,433 tons to 427,686 tons

- 400 Series: −1,438 tons to 129,424 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

|

Jul 24th |

67,910 | 436,119 | 129,424 | 633,453 |

| Jul 31th | 65,101 | 427,686 | 127,986 | 620,773 |

| Difference | -2,809 | -8,433 | -1,438 | -12,680 |

Key Drivers:

- Lower spot arrivals, especially Hongwang materials

- Strengthened procurement in 200 series due to price rebound

- Higher agent activity in 300 series amid favorable macro signals

RAW MATERIALS | Ferromolybdenum Surge Prompts Steel Mill Response

Ferromolybdenum prices jumped 14.1% over the week, rising from US$33,800 to US$38,569/MT. The rally spilled over into 316L stainless steel sheet pricing, with Yongjin cold-rolled quotes up 4.72% to US$3422/MT.

However, concerns around speculative overheating are rising. On July 30, TISCO, CITIC Pacific Special Steel, and Tsingshan jointly suspended ferromolybdenum procurement, signaling growing unease over irrational volatility in the molybdenum market.

POLICY & MACROECONOMICS | "Anti-Involution" Push Unclear, Tariff Risk Rising

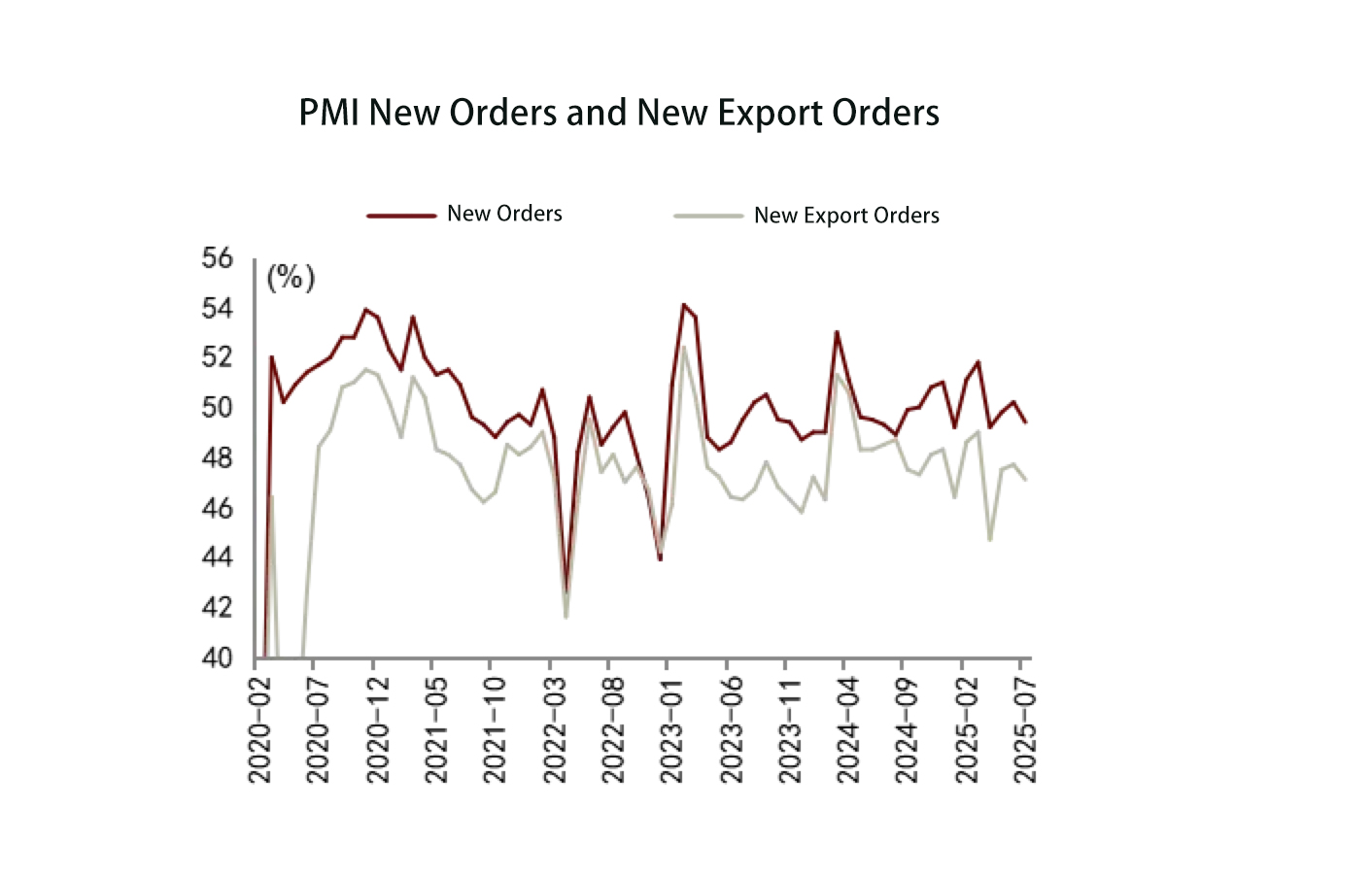

China PMI Falls Below Expectations:

In July, China's Caixin Manufacturing Purchasing Managers' Index (PMI) dropped by 0.4 percentage points to 49.3%, missing market expectations (Bloomberg consensus: 49.7%).

The contraction reflected weakening demand, with new orders shrinking more than production:

- New orders: down 0.8 ppt to 49.4%

- Production: down 0.5 ppt to 50.5%

- Backlogs: fell 0.5 ppt to 44.7%—a historic low

- New export orders: declined 0.6 ppt to 47.1%

Beijing has suffered from the continuous rainstorms.

Despite earlier export optimism from tariff relief, the latest data suggests the benefit has been priced in. Domestic demand is weakening faster than overseas demand, with real estate and weather-related disruptions hurting construction activity. Input prices surged 6.2 ppt to 54.5%, while output prices rose just 0.9 ppt to 49.2%, compressing margins across the manufacturing sector.

We have a video explaining the recent hot topic about Anti-inlusion in China and how it affects commodoty market: https://youtu.be/mJfBwLI-G0Q?si=sRI81Xm1IZqAVaKy

Brazil Enacts Anti-Dumping Duties:

On July 28, Brazil's GECEX finalized duties on stainless steel welded tubes from India and Taiwan:

- India: US$397.42 – US$1,207.06/ton

- Taiwan: US$1,258.77/ton

The ruling applies to 304 and 316 grade stainless steel tubes, with diameters of 6mm to 2032mm.

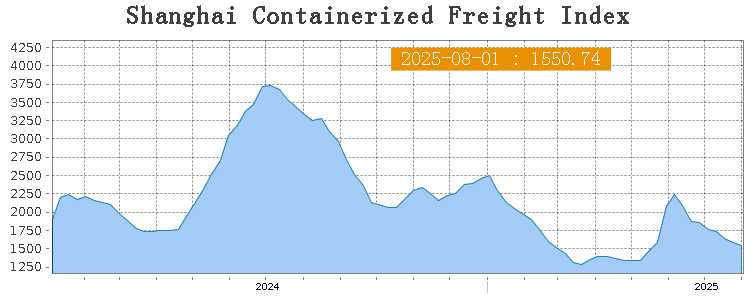

SHIPPING | Freight Rates Slide Amid Tepid Demand

The Shanghai Containerized Freight Index dropped 2.6% to 1550.74. Key observations:

- Europe/Mediterranean: Rates fell 1.9% and 3.5%, respectively

- North America: Rates to US West and East dropped 2.2% and 7.5%

- South America: Rates declined sharply by 10.1%

- Australia/NZ: Rates rose 4.7%

- Persian Gulf: Stable, with marginal 0.1% increase

U.S. durable goods orders fell 9.3% MoM, indicating corporate caution. China-U.S. trade negotiations yielded a 90-day extension of mutual tariff suspensions, offering slight relief.

OUTLOOK | What to Watch

300 Series: - Prices likely to mirror futures in short term - Monitor macro policy follow-through, steel mill production cuts, and inventory dynamics

200 Series: - Supportive outlook as downstream cautiously replenishes - Monitor Beigang’s production ramp-up and potential supply pressure

400 Series: - Prices likely to remain stable - Watch for raw material cost trends and inventory adjustments

About JINLING METALS

JINLING METALS supplies high-quality stainless steel coils, sheets, and tubes to global markets. With a focus on raw material optimization and fast delivery, we serve clients across cookware, construction, and industrial sectors.